This is not financial advice, I’m sharing my investments. seek independent

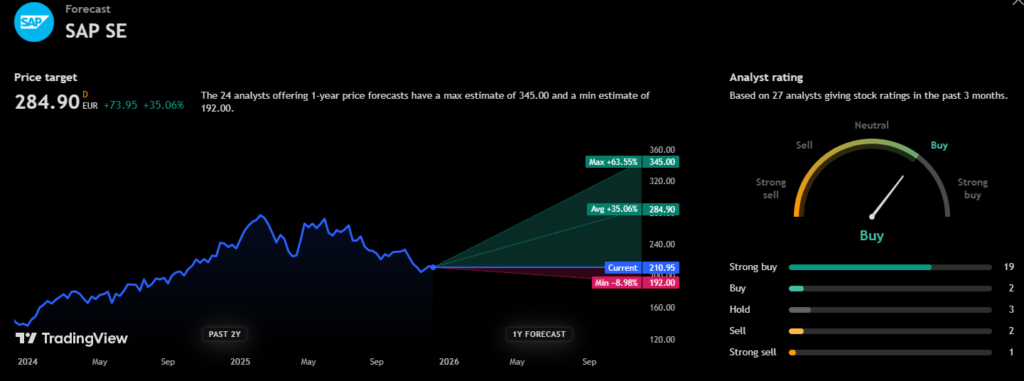

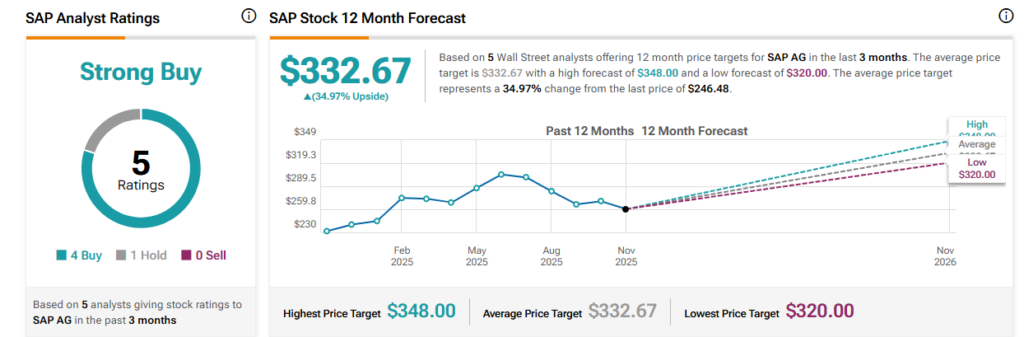

Lets start with SAP, the German-based multinational business company that is best known for its expertise in enterprise resource planning. The company was founded in 1972, and has lived through the digital transformation of the business world. Today, SAP is a leader in AI. The company has woven the new tech into every aspect of its product offerings, so that customers don’t have to worry about the ‘fit’ of an AI bolt-on; the systems are built to unite AI and data applications seamlessly, to power adaptations and innovations.

Looking at the company’s financial results, in 3Q25, total revenue came to 9.07 billion euros, for a 7% year-over-year increase. The company’s bottom line came to 1.59 euros per share, by non-GAAP measures. SAP reported a strong cloud backlog, totalling 18.8 billion euros, at the end of Q3; this figure was up 23% year-over-year.

Trane Technologies TT

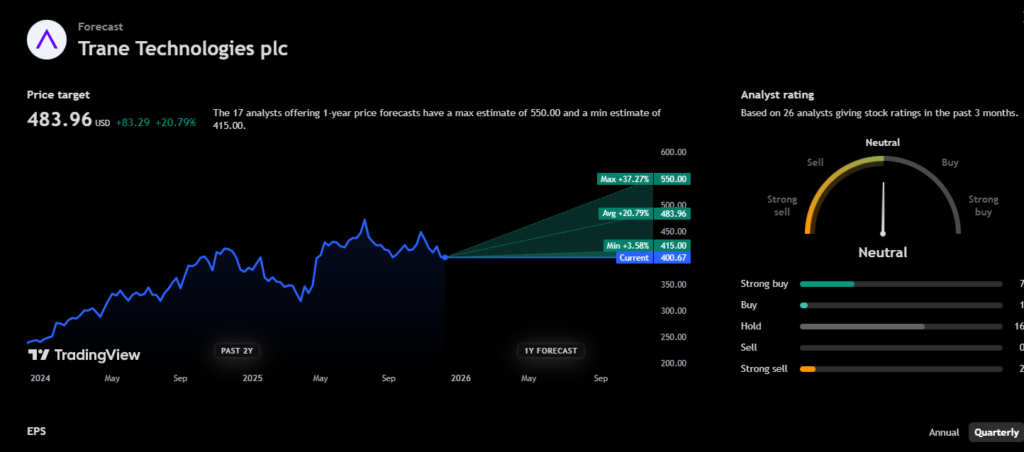

The next stock a major player in the HVAC world – heating, ventilation, air conditioning. This is a major segment of building and construction technology, and Trane is an $88 billion player with a long history in the field. The company offers products designed to create or enhance comfortable indoor environments, and they are used in residential, commercial, and industrial locations.

This stock has caught the attention of Bank of America’s 5-star analyst Andrew Obin. Obin has noted several reasons why TT shares should show gains in the coming year, and sums them up clearly, writing, “(1) Trane has executed well through the resi slowdown in 2H25 and should get the potential upside in 2026; (2) Trane should benefit from Americas Transport recovery in 2026; (3) Trane benefits from strong exposure to applied HVAC, ~22% of revenue;… Trane’s applied business has remained strong, with CHVAC booking and sales up in all three regions in 3Q.

Financial Disclaimer

The information shared on this website and across my social media channels is provided for general information and educational purposes only. I am not a licensed financial adviser, and nothing published or shared should be considered financial, investment, legal, or taxation advice. Any opinions expressed are my own and do not take into account your personal objectives, financial situation, or needs. All investments involve risk. Past performance is not a reliable indicator of future performance, and there is no guarantee of returns. You should always conduct your own research and seek independent advice from a qualified financial professional before making any investment decisions. By accessing or relying on this information, you acknowledge that any investment decisions you make are entirely your own responsibility.